Frequently Asked Questions

Why do businesses need accounting?

Accounting is a way to keep track of your company’s income and expenses, assets and liabilities including what others owe to the company and what the company owes others. It also helps you to see the profitability of your company, department or project and provides useful information for better business insights and decision making. Equally important, accounting fulfils your requirement to report on your Financial Statements for ACRA annual returns and IRAS tax filing.

What are the accounting standards used in Singapore?

Singapore-based entities generally use the Singapore Financial Reporting Standards (SFRS) which is based on the International Financial Reporting Standards (IFRS). For smaller SMEs, the SFRS for Small Entities can be used.

What does your accounting services encompass?

We provide a full range of accounting-related services:

- Bookkeeping – recording of transactions (revenue and expenses) into the accounting system, categorizing the transactions to appropriate and relevant accounting categories.

- Financial Reporting – closing of management accounts through bank reconciliation, passing journal entries, preparation of Balance Sheet, Profit & Loss statement, accounting schedules and General Ledger.

- Financial Statements – generating of financial report consisting of Statement of Financial Position, Statement of Profit & Loss, Statement of Changes in Equity, Statement of Cash Flow and Notes to the Accounts in accordance with Financial Reporting Standards.

- As part of our ESG motivation, we usually try to work on a paperless basis and encourage clients to use soft copies or OCR technology to electronically capture data into the accounting system. Meanwhile, we are also equally happy to work with paper documents at your request.

What are some important timelines to take note for accounting matters?

Financial Statements - within 6 months after Financial Year End

What is required for tax reporting in Singapore?

In general, Singapore-registered companies will need to file Form C-S or Form C in the annual tax reporting to IRAS. From YA2012, IRAS has introduced Form C-S, which is a simplified Income Tax Return for qualifying small companies to report their income to IRAS. SMEs that meet all the following criteria may file for Form C-S:

- Company is incorporated in Singapore

- Company has an annual revenue of S$5 million or below

- Company only derives income taxable at the prevailing corporate tax rate of 17%

- Company is not claiming any of the following in the Year of Assessment (YA):

- Carry-back of Current Year Capital Allowances / Losses

- Group Relief

- Investment Allowance

- Foreign Tax Credit and Tax Deducted at Source

When does my company need to be GST registered?

Your company needs to be GST registered if your taxable revenue turnover is:

- Under the retrospective view, more than S$1 million at the end of the calendar year, or

- Under the prospective view, expected to be more than S$1 million in the next 12 months

You will not be required to register for GST if your company’s taxable revenue turnover is derived wholly or mainly from zero-rated supplies and you apply for exemption from registration.

Can I voluntarily register with IRAS to be GST-registered?

Yes. Before registering for GST voluntarily, you should consider whether:

- You qualify for registration

- You are able to meet the requirements for voluntary registration

- The benefits outweigh the costs of registering for GST

You may visit the IRAS website for 'Factors to consider before Registering Voluntarily for GST'

What does your tax and GST services include?

We can support you in your annual tax returns reporting and quarterly GST reporting to IRAS.

- Yearly Estimated Chargeable Income (ECI)

- Yearly Corporate Income Tax computation and Annual Tax Returns (Form C-S or Form C)

- Quarterly Goods and Services Tax (GST) filing (Form F5)

- Other tax matters and reporting

What are some important timeline to take note for taxation matters?

- Estimated Chargeable Income (ECI) – 3 months after Financial Year End

- Corporate Income Tax computation and Annual Tax Returns (Form C-S or Form C) – By 30 November after Financial Year End

- Goods and Services Tax (GST) – 1 month after each accounting quarter

What are the current CPF contribution rates?

Generally, for a Singapore Citizen or Singapore Permanent Resident (SPR) from the third year of SPR status below 55 years old, Employees' contribution rates are 20% and Employers' contribution rates are at 17%. Otherwise, CPF Board provides a table for the exact computation for each category of employees. For more information, you may visit CPF Board website on 'How much CPF contributions to pay'.

What else does my company need to take note of in our monthly payroll processing?

Below are a few things your company should take note of on top of ensuring everyone is paid accurately and on a timely basis:

- Itemised payslip for all employees is a requirement

- CPF contribution rates differ from person to person, depending on citizenship and age and are contributed by both employee and employer

- Contribution to Self-Help Groups (SHGs) is a requirement but employees may choose to opt-out

- Skills Development Levy (SDL) is a compulsory levy that you have to pay for all your employees working in Singapore, at 0.25%, between S$2 to S$11.25

What does your payroll package cover?

Our payroll support services include:

- Computation of monthly payroll

- Preparation of monthly payroll summary

- Preparation of itemized payslips per requirements

- Preparation of monthly CPF submission

- Preparation of annual IR8A reporting

What are some important timeline to take note for payroll matters?

- CPF submission – due end of each month and payment to be made by 15th of the following month

- IR8A for employees – to be filed by 1 March of the following year

What is ACRA?

The Accounting and Corporate Regulatory Authority (ACRA) is the regulator of business registration, financial reporting, public accountants and corporate service providers; it also facilitates enterprise. They provide a trusted and vibrant environment for businesses to thrive and flourish, and contribute towards making Singapore the best place for business.

Who must register with ACRA?

Every company conducting business in Singapore needs to register with ACRA.

What do I need to get started?

To register a Singapore business, you need to have a local address (registered office or home), a licensed corporate secretary, a director who is a Singapore resident and a paid-up capital starting from S$1.

How long does Incorporation of a Company take?

If all the documents are ready, it takes just less than an hour for us to incorporate your company. It mostly depends on the completeness of the documents provided and ACRA’s service hours.

Is a Company Address required?

Yes, all Singapore incorporated companies must have a local registered address. It goes on all government-related documents. If you do not have an office address, use our registered office address service. You may also register your home address under the Home Office Scheme, which is subjected to approval.

What date should I set as the Financial Year End (FYE) for my Company?

- You can choose any date as your company’s FYE. Common choices include 30 June or 31 December.

- Deciding on the FYE is important as it will determine when your corporate filings and taxes are due every year.

Who can be a Director?

- Anyone above 18 who is not an undischarged bankrupt can be a director. Every company must have at least one director who is a local resident in Singapore.

- Employment Pass (EP) and Foreign Identification Number (FIN) holders will need to get consent from relevant authorities on their eligibility before registering or accepting an appointment to be a company director.

Is it necessary to have a Corporate Secretary?

- According to ACRA, every company must appoint a corporate secretary within 6 months from the date of incorporation. The company secretary must be residing locally in Singapore and he/she must not be the sole director of the company.

- A corporate secretary oversees all the administrative and reporting responsibilities that the company is obligated to adhere by the law. This includes maintaining / updating registers, ensuring filing of annual returns are done on a timely basis, and more.

What do your corporate secretarial services include?

Our corporate secretarial services include:

- Corporate Secretarial Service per annum, including preparation of documents for Company Annual General Meeting (“AGM”) and provision of lodgement of statutory returns with Accounting and Corporate Regulatory Authority (“ACRA”)

- A named company secretary for 12 months period

- Maintaining custody and updating the Register of Controllers. Keeping records of sending of notices and the receipts of replies to such notices on behalf of the company per annum

- Maintaining custody and updating the Register of Nominee Directors. Keeping records of all related correspondences on behalf of the company per annum

Can you do my Post-Incorporation Documents if I have already incorporated the company by myself?

Yes, we do this as a service for a fee to be quoted and if you engage us as your corporate secretary for the subsequent years, we will give you a discount on the fees!

What are some important timelines to take note for corporate secretarial matters?

- Annual General Meeting – within 6 months after Financial Year End

- Annual Returns Filing – within 7 months after Financial Year End

- Update to ACRA on certain resolutions or change of information for the company – within 14 days

Who is a Virtual Assistant?

Our Virtual Assistants are familiar with the ins-and-outs of administrative work, are detail-oriented, and are friendly and personable. They are hired by us and dedicated to your tasks.

What is Virtual Assistant Service?

Administrative work, though necessary, may take up substantial time resources of your business. You can outsource these administrative chores to us and pay only when there is administrative task to complete while not having to incur unnecessary headcount or overhead costs. You can also focus more on the higher value adding activities of your business. Let us support you in all the tasks you shouldn’t be handling further!

What does your support as a virtual assistant entail?

Our Virtual Assistants support includes but not limited to:

- Admin support (preparing of memos / meeting minutes, transcribing of interviews, creating forms / templates, online research, filing and other clerical tasks)

- Data entry (database building, updating of contacts or CRM)

- Email & calendar management (sending of emails including greeting cards and event invitations, answering of customer services emails / tickets / chat support, filtering of emails and managing spam inbox, and managing calendar appointments

How will my Virtual Assistant work with me?

- Indicate your required scope of support (we will set you up with an Assistant within 48 hours of the request)

- Set tasks, timeline, and expectations (let your Assistant know what’s expected of them including software to get the task done)

- Assistant to work on the task within stipulated time

- Your task is done! (you can continue to assign new tasks to your Assistant if you have remaining hours in the support package purchased)

Who is an Outsource CFO?

Imagine having a go-to finance expert that could help you solve all of your company’s most challenging financial problems. Now you can take your business to the next level with our outsource CFO service. Our people are seasoned practitioners having been CFO of SMEs and public listed company, private equity investment professional, chartered accountant, corporate banker, auditor and capacity building of financial functions for the non-profit organisations and charities.

What is Outsource CFO Service?

Every business can benefit from dedicated financial management expertise, but very few small businesses have the means to hire someone full time—particularly in the early or growth years. Unfortunately, it’s those first few years when a company is just starting up that establishing good habits with managing financial resources is so important, and, over time can even make or break a business.

Hiring a outsource CFO is an affordable option for business owners who recognize the need for a financial expert with small business experience. Outsource CFOs provide top level advice just when you need it, offering incredible value and cost savings to companies focused on growth and long term success.

What kind of CFO package does my business require?

You are unique. So is your business and its growth journey. Getting access to the right level of CFO support is determined by a number of factors including company size, growth rate, complexity, scope of work and your budget considerations.

Set up a call with our team to delve into your specific needs and to find the perfect package for your next chapter of scaling up.

What is statutory audit?

A statutory audit is a type of external audit usually conducted annually to meet a specific set of regulations set by the legislation. Such an audit is required by the laws of the stipulated governing Act. In Singapore, the Accounting and Corporate Regulatory Authority (ACRA) is the authority that governs the laws and regulations of companies.

Is my company required to have a statutory audit?

In Singapore, all companies are required to appoint an auditor within 3 months of its incorporation unless exempted from an audit. The audit exemptions apply for companies that fall under the “Small Company” or “Small Group” category.

As per Company’s Act, a company qualifies as a small company if it is a private company in that financial year and it meets at least two of the three criteria for immediate past two consecutive financial years:

- Total annual revenue ≤ S$10m

- Total assets ≤ S$10m

- Number of employees ≤ 50 pax

For a company that is part of a group to qualify for audit exemption:

- The company must qualify as a small company; and

- Entire group must be a “small group”

For a group to be a small group, it must meet at least two of the three criteria on a consolidated basis for the immediate past two consecutive financial years:

- Where a company has qualified as a small company, it continues to be a small company for subsequent financial years until it is disqualified. A small company is disqualified if:

- It ceases to be a private company at any time during a financial year; or

- It does not meet at least two of the three criteria for the immediate past two consecutive financial years

- Where a group has qualified as small group, it continues to be a small group for subsequent financial years until it does not meet at least two of the three criteria for the immediate past two years

Can you handle the audit liaison for my company?

For our accounting clients and when an audit is required, we can liaise with your company’s appointed audit firm to get the audit completed in an efficient and stress-free manner for you. Our audit liaison service includes:

- Attending to auditor’s queries during the audit period

- Preparing audit schedules for audit purpose

- Reviewing of audit adjustments (if any) and financial contents of the Financial Statements

Customised Package/Solution

Need help but not sure what you require or what is the best suitable solution for your business? Or need a tailored and customised package of solution? We love meeting founders and executives! Jump on a call with our team to answer any questions you may have.

PSG Grant

The Productivity Solutions Grant (PSG) supports SMEs keen on adopting IT solutions and equipment to enhance business processes.

Receive up to 70% funding with the Productivity Solutions Grant (PSG) for your cloud accounting solution!

As a pre-approved PSG vendor for Xero accounting solution, we bring to you one of the best accounting technology to make your business more efficient and embark on a journey of digital transformation.

Which solution do you currently assist in onboarding and implementation?

If you are currently exploring a cloud-based accounting software, connect with us to learn more about Xero, our Xero adoption support as well as our accounting shared services. We would be happy to share more with you.

Xero is one of the fastest-growing and most popular cloud-based software solutions in the market thanks to its ease of use and versatility. Indeed, Xero is packed with features and integrations that make it suitable for multiple types of businesses and sectors.

How much grant can my SME get?

SMEs can get up to 70% funding support from 1 April 2022 for eligible costs. For Food Services and Retail, the support level will be up to 80% funding from 1 April 2022 to 31 March 2023.

What type of solutions does PSG cover?

PSG covers sector-specific solutions including retail, food, logistics, precision engineering, wholesale, building and construction, financial service, and landscaping industries. Additionally, PSG supports adoption of broad-based solutions that cut across industries, e.g., financial management, human resource management, inventory tracking, customer management and data analytics.

Who qualifies for PSG?

- Companies registered and operating in Singapore

- Companies with at least 30% local shareholding

- Companies with annual sales turnover of less than S$100 million OR fewer than 200 employees

- Purchase of IT solutions must be used in Singapore

*To find out more about PSG, EDG, Digital Solutions and Business Advisory, please GET IN TOUCH

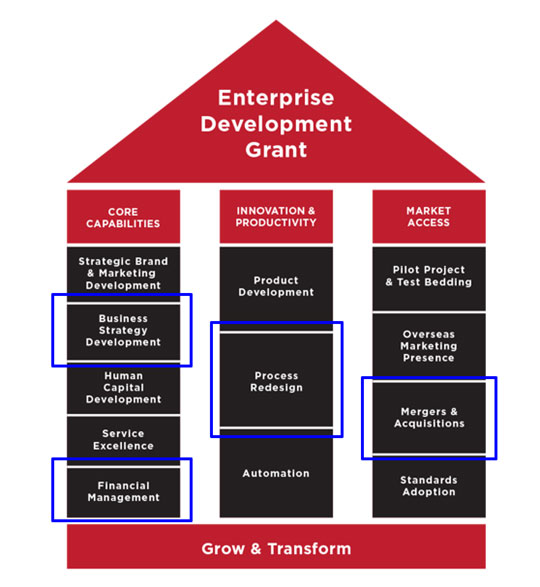

What is EDG Grant and what are the advisory we provide that are supported with EDG grant?

The Enterprise Development Grant (EDG) is a government grant aimed at helping SMEs to grow and transform by funding eligible projects up to 70% of the qualifying project cost. This grant supports projects that help you upgrade your business, innovate or venture overseas, under three pillars:

- Core Capabilities

- Innovation & Productivity

- Market Access

As accredited certified management consultant recognised by Enterprise Singapore, we provide advisory for these projects with EDG grant from Enterprise Singapore of up to 70%:

- Business Strategy Development

- Financial Management

- Process Redesign

- Mergers & Acquisitions

Who can apply?

To qualify for the EDG, your company:

- Is registered and operating in Singapore

- Has a minimum of 30% local shareholding

- Is financially capable to complete the project

What does the EDG support?

The grant funds qualifying project costs namely third party consultancy fees, software and equipment, and internal manpower cost.

When must an EDG funded project be completed?

Most projects undertaken by companies should be completed within 6 to 12 months upon successful grant application.

How can I apply for EDG grant?

You may apply for the Enterprise Development Grant (EDG) via the Business Grants Portal. Verz Design is EDG Certified to assist you with this process. You can refer to below steps to get started:

- Schedule a Consultation

- Apply for EDG Grant

- Wait for Approval

- Execute the Recommended Digital Marketing Practices

- Submit EDG Claim

What documentation would I need to have or prepare in order to apply for EDG grant?

Please prepare the following documents:

- Audited Financial Statements

- Your company ACRA Business Profile

- EDG Project Proposal

- Cost Quotation & Scope of Work from Consultant

- Consultant’s Certification

When will I get the result of my EDG application?

It may take up to 8 weeks or more before you can get any confirmation from Enterprise Singapore.

What is the difference between EDG Grant and PSG Grant?

The Enterprise Development Grant (EDG) is a capability enhancement grant for companies who want to upgrade their business, innovate or venture overseas under three pillars: Core Capabilities, Innovation & Productivity, and Market Access.

The Productivity Solution Grant (PSG) is an IT Solution Grant for companies who are keen to adopt IT solutions and equipment to improve their business process or productivity.

PSG solutions are often products or solutions that can be purchased off-the-shelve (equipment or subscription) bundled together with implementation and training. EDG packages on the other hand often require detailed and customised advisory solution to address specific needs of the company.

*To find out more about PSG, EDG, Digital Solutions and Business Advisory, please GET IN TOUCH

What is cloud technology?

Cloud technology refers to a model of network technology where a program or application is able to run on a connected server rather than on a local computing device. This hosted program or application can be accessed by any internet-enabled device such as PC, tablet or a smartphone.

Cloud technology has significantly changed the way in which we conduct business. The available technology platforms nowadays are more connected and integrated, and enable real-time reporting capabilities, resulting in more automated processes, faster client delivery, better efficiency and improved data transparency and accuracy.

What is cloud accounting?

Cloud accounting refers to an online accounting software or web-based accounting software where the accounting software is hosted on a remote server, such as Amazon Web Services. Some of the benefits of cloud accounting include:

- Being able to access accounting data anytime from anywhere. This enables business owners like yourself to see the business account balances, outstanding invoices, overall cash position and much more on a real-time basis.

- Being secure. Cloud accounting software maintains high security standards. Moreover, backups are done at regular intervals, servers are scanned for vulnerabilities and data is transferred over an encrypted connection.

- Being lower in cost of ownership. Cloud accounting does not require you to incur installation or maintenance cost. Software updates are automatically carried out by the software provider without any user intervention.

- Being able to integrate with other cloud softwares. The cloud accounting softwares we work with are able to integrate with various other cloud applications such as:

- HR and payroll applications

- Warehouse and inventory management applications

- Point-of-sale (POS) applications

- Customer relationship management (CRM) applications

- Various other applications

- Being able to allow remote collaboration. Cloud accounting enables business owners, accountants and other team members to work on the same application simultaneously eliminating the need for data transfer and physical meetings.

What should my company take note of during digitisation projects?

When building a house, one does not straight away buy some bricks and start building the house, hoping that the home will have a solid and stable foundation. One first consults an architect to design the home, ensuring it is structurally sound before the actual building phase.

The same approach is applicable for any cloud implementation. For us, we are here to support you in the design of your new or improved business workflow in conjunction with cloud applications that best suit your business needs. Through a consultative process, our team looks at your current pain points and your nice-to-haves. After which, the future workflow using the new cloud applications is co-curated together with you with potential cloud integration between your different business functions.

What does your digital solutions package includes?

Our digital solution package encompasses the following:

- Understanding your business needs and workflow

- Setting up your Chart of Accounts, invoicing templates, products and services listing, and reporting presentation (for cloud accounting solution)

- Setting up your payroll / leave / other staff benefits, creating individual staff user accounts, transferring of year-to-date information of employee income and contributions to new solution (for HR cloud solution)

- Integration of solutions (should you onboard on to both accounting and HRM cloud-based integrable solutions or other cloud based solutions that can integrated with the accounting solution)

- Training of users to use the new cloud solution

Which solution do you currently assist in onboarding and implementation?

If you are running a business or start-up, you probably know how important good financial management, productivity and employee experience are to the success of your company.

SMEs need to manage their finance and employee engagement effectively, so they can be better prepared to handle the ups and downs of entrepreneurship and cloud-based solutions can play an important role in this.

At Agarwood Corporate Services, we have been working with various popular cloud-based solutions in the market (Xero, QuickBooks Online, Justlogin, Talenox, etc.) thanks to their ease of use and versatility. These solutions are packed with features and integrations that make it suitable for multiple types of businesses and sectors.

If you are currently exploring a cloud-based software, connect with us to learn more. We would be happy to share more with you.

*To find out more about PSG, EDG, Digital Solutions and Business Advisory, please GET IN TOUCH

Business Advisory

We are here to walk the journey together with you to help build and grow your business, and towards realization of shareholder value!

*To find out more about PSG, EDG, Digital Solutions and Business Advisory, please GET IN TOUCH

What is your business’ Corporate Social Responsibility?

We place importance in contributing back sustainably to the community. This is especially so if our business activities can contribute towards the global Sustainable Development Goals (SDGs) such as inclusive hiring and having environmentally friendly considerations.

At Agarwood Corporate Services, we value diversity and inclusive hiring. We work closely with our partners in the differently abled community space (raiSE, SADeaf and SG Enable) to provide employment for PwDs (Persons with Disabilities) including the hearing impaired and physically handicapped.

Additionally, we encourage one another to be more environmentally conscious. With cloud-based technology here to stay, it helps to create a digital environment that minimizes the use of paper, reduces work travel, and is beneficial for the environment.

Why Choose Us?

- We believe in journeying with our clients to better understand your business needs, support you where needed and simplify your work processes to allow you more time to focus on your business and the things that matter.

- We have a committed team with extensive experience in the various areas of accounting, finance, HR and digitalization to deliver quality and reliable services to you at competitive rates.

Who Works With Us?

- Our Clients, many of whom are successful businesses in their own fields and industries. There is a reason why they choose to work with us.

- Our Partners, many of which are leading technological solutions in the market, including leading edge cloud-based accounting software, payroll software and other integrative solutions etc.

- Our differently abled Community, for we are inclusive hirer employing PwDs (Persons with Disabilities) including the hearing impaired and physically handicapped, under the supervision of our experienced managers, through our social partners like raiSE, SADeaf and SG Enable.

What It Means If We Can Serve You?

- You get corporate services that will work for your business.

- You will get more than just corporate services, for we bring forth business consulting and investment expertise that could add value and make your business management successful.

- You will help us contribute to our social impact positively and sustain the opportunity for our PwDs (Persons with Disabilities) teammates to hold onto esteemed career with higher output for our society and economy.

How To Join Us?

- We regard each team member as our greatest asset, valuing each person’s contributions and bringing out their best through opportunities in professional growth. If you are an accounting / tax professional, we invite you to be part of our dynamic team. Simply email us your resume and cover letter via [email protected].

- We also have hiring cycles in partnership with our key partners (raiSE, SADeaf and SG Enable). You may look out for the openings through our partners. If you have any enquiries, feel free to drop us an email via [email protected].

Why do businesses need accounting?

Accounting is a way to keep track of your company’s income and expenses, assets and liabilities including what others owe to the company and what the company owes others. It also helps you to see the profitability of your company, department or project and provides useful information for better business insights and decision making. Equally important, accounting fulfils your requirement to report on your Financial Statements for ACRA annual returns and IRAS tax filing.

What are the accounting standards used in Singapore?

Singapore-based entities generally use the Singapore Financial Reporting Standards (SFRS) which is based on the International Financial Reporting Standards (IFRS). For smaller SMEs, the SFRS for Small Entities can be used.

What does your accounting services encompass?

We provide a full range of accounting-related services:

- Bookkeeping – recording of transactions (revenue and expenses) into the accounting system, categorizing the transactions to appropriate and relevant accounting categories.

- Financial Reporting – closing of management accounts through bank reconciliation, passing journal entries, preparation of Balance Sheet, Profit & Loss statement, accounting schedules and General Ledger.

- Financial Statements – generating of financial report consisting of Statement of Financial Position, Statement of Profit & Loss, Statement of Changes in Equity, Statement of Cash Flow and Notes to the Accounts in accordance with Financial Reporting Standards.

- As part of our ESG motivation, we usually try to work on a paperless basis and encourage clients to use soft copies or OCR technology to electronically capture data into the accounting system. Meanwhile, we are also equally happy to work with paper documents at your request.

What are some important timelines to take note for accounting matters?

Financial Statements - within 6 months after Financial Year End